As a business owner, you want your organization to grow and ultimately flourish. But how, exactly, do you facilitate that? Do you try to sell a lot of items to create an abundance of revenue, or do you try and become as profitable as possible? And what approach is the best one to take for your business?Typically, businesses prioritize the maximization of either profits or revenues, but these two strategies don’t have to be mutually exclusive. They serve different purposes in business; revenue maximization can be beneficial in the short-term, but profit maximization is a long-term strategy intended to promote lasting business success. You can use a combination of both of these methods to reach your own specific goals, but, depending on what you want to accomplish, one strategy might be better for your business than the other.

Revenue Maximization

Profit Maximization vs. Wealth Maximization. Profit maximization is often seen as a more short-term approach. Businesses who use this financial management system focus on how the business can increase profits and reduce both losses and risk. Here are some of the common features of profit maximization in financial management: Primarily focused. The advantages of using the method of classification of expenses by na ture: - Allows the use of profit and loss account in the calculation of intermediate balances, allows macroeconomic aggregate.

Revenue maximization is the theory that if you sell your wares at a low enough price, you will increase the revenue you bring in by selling a higher total volume of goods. However, maximized revenue does not equate with maximized profits, as you may have to sell your goods at a loss to get them off of your shelves. If you choose this strategy, your goal is to increase volume of goods sold, not the profit you make off of selling those goods.Revenue Maximization Pros

Naturally, there are a number of advantages that come from maximizing revenue without focusing on profits, otherwise business owners would never use this strategy. Revenue maximization is a simple way to increase your customer base. By having tantalizingly low prices, you can bring in customers who typically wouldn’t spend money on your products or draw them away from your higher-priced competitors.Revenue maximization is also a useful way to avoid issues with your supply chain, quickly increase your cash flow, and improve your overall business operations. You can employ this strategy to sell off excess inventory, which can help move products that aren’t selling well, get rid of seasonal goods, and make room for products that you expect to sell for a larger profit. A trustworthy inventory management software solution can help you identify which products are best-suited for this method, allow you to keep track of how much inventory is going out, and know how much room you have for new goods.Revenue Maximization Cons

Revenue maximization is not a perfect way to run your business. The primary issue with utilizing this type of strategy is that it works well only in the short-term. Your business can sacrifice profits for revenue for a little while, but will collapse if you take this approach for long periods of time. Because many business owners forgo making a profit to increase revenue, this is an unsustainable practice for long-term business success. It must be done incrementally and very strategically to leverage the benefits without it becoming a losing proposition.Profit Maximization

Generally speaking, most successful businesses primarily operate under a profit maximization model. Profit maximization is similar to revenue maximization, but differs greatly in its financial intention: the goal of profit maximization is not to increase the volume of goods sold, but to increase the amount of money earned from selling those goods. It’s not simply about selling your wares at a higher price point or generating cash flow, but also involves making money off of your investment in materials, labor, and other expenses. This is a long-term strategy that not only sustains a company, but helps foster its growth.Profit Maximization Pros

Businesses maximize their profits to make money, which is not only a benefit, but something all companies need to survive. This is the “default” state of any organization, so to speak, and it should be your primary, long-term goal if you want to see your business flourish. Profit maximization is a necessity to both the survival and growth of your business.Profit Margin Cons

Though profit maximization is an essential strategy for businesses, there are still disadvantages to using this model. First and foremost, it’s difficult to get started with this method, as you have to build up the perception of value of this item and get people to actually purchase it. However, this can easily be remedied by using a loss leader strategy

However, this can easily be remedied by using a loss leader strategyAdvantages And Disadvantages Of Profit Maximization Pdf Download

, wherein you purposefully sell a particular item below its cost to attract customers. Theoretically, customers then purchase other products at full-price and on which you can make a profit. Of course, you will not make any profits if customers only purchase the loss leader item, so there is some risk to using this strategy to help drive profits.Prioritizing a profit maximization strategy when your inventory is overstocked can also be tricky. Overstocking is one of many common mistakes with inventory management; when you expect that certain items will move quickly, it can be an effective way to satisfy customer demand, but when business is slow, it can lead to a huge loss in net profits. In this situation, it’s likely better to focus on maximizing revenue instead.Which Strategy Is Better?

Neither of these strategies is inherently better than the other; your own circumstances will determine which one is “best” for you. Tracking your inventory metrics can help you make this decision by identifying areas where you are excelling as well as areas where you have room to grow. For most businesses, it’s all about finding the right balance between these two strategies. They can be used simultaneously to accomplish your goals for profit, revenue, and overall growth. The longevity of your business is dependent on your profits, but if you are trying to target a new customer base or overcome a seasonal slump, you may need to maximize your revenue to better support that long-term goal. Both strategies have their benefits and flaws, and as a business owner, you need to determine how to utilize them to minimize those flaws, while maximizing their benefits.Advantages And Disadvantages Of Profit Maximization Pdf Free

The objective of a Financial Management is to design a method of operating the Internal Investment and financing of a firm. The two widely used approaches are Profit Maximization and Wealth maximization.

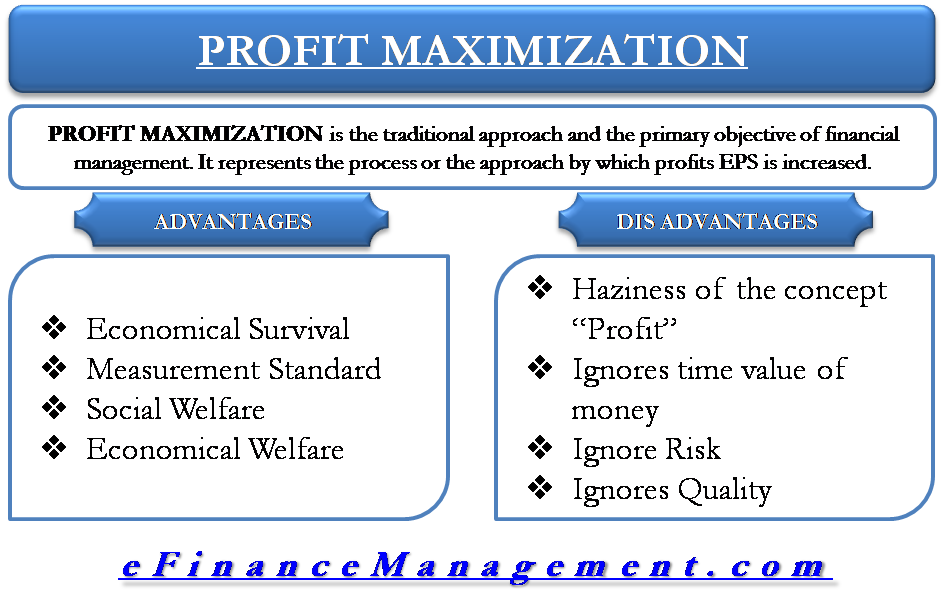

Profit maximization: Profit maximization is considered as the goal of financial management. In this approach actions that increase the profits should be undertaken and the actions that decrease the profits are avoided. The term 'profit' is used in two senses. In one sense it is used as an owner oriented. In this concept it refers to the amount and share of national Income that is paid to the owners of business. The second way is an operational concept i.e. profitability. It is the traditional and narrow approach, which aims at, maximizes the profit of the concern. The Ultimate aim of the business concern is earning profit, hence, it considers all the possible ways to increase the profitability of the concern. Profit is the parameter of measuring the efficiency of the business concern. So it shows the entire position of the business concern. and hence Profit maximization objectives help to reduce the risk of the business. Its main aim is to earn profit. In this criteria Profit is the main parameter of business operation. It reduces the risk of business concern. In this criteria profit is the main source of finance and profitability meets the social needs.

Advantages And Disadvantages Of Profit Maximization Pdf Template

Some of the unfavorable arguments of profit maximizations are that it leads to exploiting workers and consumers. It also creates immoral practices such as corrupt practice, unfair trade practice, etc. It also creates inequalities among the stake holders such as customers, suppliers, public shareholders, etc.

Some of the drawbacks of profit maximizations are

- In Profit Maximization, profit is not defined precisely or correctly. It creates some unnecessary opinion regarding earning habits of the business concern. For example, profit may be long term or short term. It may be total profit or rate of profit. It may be net profit before tax or net profit after tax. It may be return on total capital employed or total assets or shareholders equity and so on.

- It ignores the time value of money:Profit maximization does not consider the time value of money or the net present value of the cash inflow. It leads certain differences between the actual cash inflow and net present cash flow during a particular period. When the profitability is worked out the bigger the better principle is adopted as the decision is based on the total benefits received over the working life of the asset, Irrespective of when they were received.

- It ignores the quality aspects of benefits which are associated with the financial course of action. The term 'quality' means the degree of certainty associated with which benefits can be expected. Therefore, the more certain the expected return, the higher the quality of benefits. As against this, the more uncertain or fluctuating the expected benefits, the lower the quality of benefits.

- It ignores risk: Profit maximization does not consider risk of the business concern. Risks may be internal or external which will affect the overall operation of the business concern.

Wealth Maximization: Wealth maximization is one of the modern approaches, which involves latest innovations and improvements in the field of the business concern. The term wealth means shareholder wealth or the wealth of the persons those who are involved in the business concern. Wealth maximization is also known as value maximization or net present worth maximization. This objective is a universally accepted concept in the field of business. It removes technical disadvantages of the profit maximization. Wealth maximization is superior to the profit maximization because the main aim of the business concern under this concept is to improve the value or wealth of the shareholders. Wealth maximization considers the comparison of the value to cost associated with the business concern. Total value detected from the total cost incurred for the business operation. It provides extract value of the business concern. This concept considers both time and risk of business concern. This criteria provides efficient allocation of resources and it also ensures the economic interest of the society. The wealth maximization criterion is based on cash flows generated and not on accounting profit. The computation of cash inflows and cash outflows is precise. Wealth maximization can be activated only with the help of the profitable position of the business concern. So The goal of maximizing the value of the stock avoids the problems associated with the different goals we discussed above.in a simple language a good financial decisions increase the market value of the owners’ equity and poor financial decisions decrease it. So the financial manager best serves the owners of the business by identifying goods and services that add value to the firm because they are desired and valued in the free marketplace. So it is a long term concept based on the cash flows rather than profits and hence there can be a situation where a business makes losses every year but there are cash profits because of heavy depreciation which indirectly suggests heavy investment in fixed assets and that is the real wealth and it takes into account the time value of money and so is universally accepted.