- Tds Working Sheet In Excel Format

- Tds Calculation Sheet In Excel Format 2021-22

- Tds Working Sheet In Excel

- Tds Working Sheet In Excel Format

- How To Prepare Tds Working In Excel

Salary slip format in Excel is given to the employees by the organization or a company in against confirmation of payment being paid. It is necessary for small as well as large organizations. In addition, excel format makes every month’s procedure of salary easier for the HR department.

What is a salary slip?

Download Excel based Income Tax Calculator for FY 2020-21 & AY 2021-22/ Income Tax Calculator Excel Download. Planning for your income tax or calculating your income tax liabilities seems to be a very daunting task for many of us. If you believed in this myth, surely the Finance Budget 2020 would prove you wrong. Taxable income (1)- (2) = 2,62,644. In case of Male Employee, Tax = (2,62,644-1,60,000)x10% = 10264.4. For Female, additional exemption of 3000 on tax is applicable. For further deduduction on Tax, there are various provisions as detailed under. Download TDS Calculator in Excel Format for Salary for Assessment Year 2019-20 (AY 2019-20 ) or Financial Year 2018-19 (FY 2018-2019 ) Also useful for computing Income Tax, Simple Excel Calculator. Know about How to Use the calculator by clicking the link of YouTube Video –.

At the end of every month, every company issues a piece of document to their employee which is known as a salary slip. Commonly, this slip is issued when salary is credited into the employee’s account. This document also serves as proof that the employer has paid and the employee has received the salary for the specified month.

Tds Working Sheet In Excel Format

Note: With the Live Update facility, the software shall be automatically updated. However, in case of any problem, you can download update patch and update software as follows. Steps to Update Software. Webtel Presents. An ERP for professional firms that helps you and your team in managing day-to-day statutory and other.

Hence, it is an important document for both employer and employee. Also, the employee needs it to prove his earnings. On the other hand, an employer needs it to prove that he has made all the dues. You may also like Rent Payment Tracker Spreadsheet.

Important elements of salary slip format in Excel:

The important elements that should be included in every salary slip are;

Employee’s information

Write down the name of the employee, his department name, and bank account number.

Basic salary:

It is the minimum payment that an employee receives each month. After deductions and commission additions, write down the payment received by the particular employee.

Allowances:

Allowances are the amount that the company gives for free to the employee. Some different types of allowances are house rent allowance, conveyance allowance, dearness allowance, medical allowance, etc.

Professional tax:

An employer can deduct the professional tax from the salary.

Tds Calculation Sheet In Excel Format 2021-22

Employee Provident Fund (EPF):

It is a mandatory government scheme. Moreover, it prevents the employees’ interest in certain situations like unemployment, illness, marriage, etc. Both employer and employee equally contribute to this scheme.

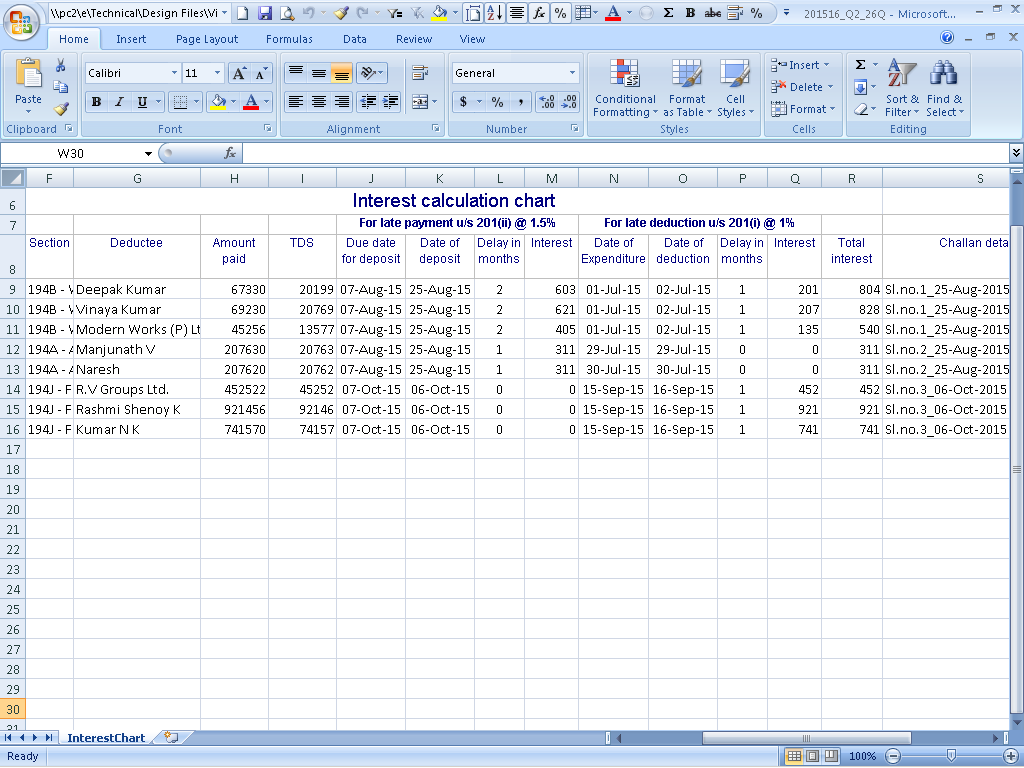

TDS:

To pay tax to the government, the employer deducts a certain income tax from the employee’s salary.

Importance of salary slip format in MS Excel:

The salary slip format in excel enables assists the organization to manage the financial record of each employee. The organization used it to determine the designation of an employee. For future legal considerations, this slip can be used against an employer. Furthermore, the employer has no time to manage and manually calculate salaries of the each employee. Thus, by using Excel salary slips, it becomes easy for them to manage the payslips of each employee.

Tds Working Sheet In Excel

It also helps to calculate the days of the employee in a month. The slips also contain information for how many days employees took leaves and what type of leaves they took. To increase the employee morale and motivation, it provides an efficient record of the employee. Additionally, if you want to take a loan from the bank then to prove your ability to repay back, the bank can demand a payslip. You should also check Template Of Sales Invoice.

Tds Working Sheet In Excel Format

Conclusion:

How To Prepare Tds Working In Excel

In conclusion, a salary slip format in excel helps the organization to make employee management processes easier and efficient. The excel format should be according to the organization and their parameters or working. The document not just includes the details of salary transfer but also contains the other parameters like service hours, extra hours, etc.